|

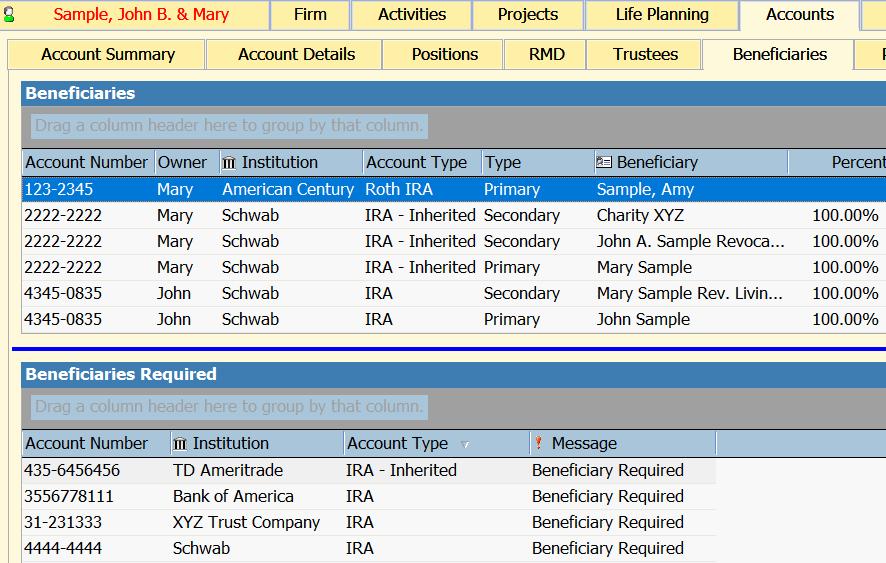

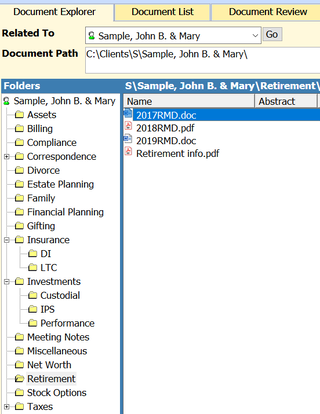

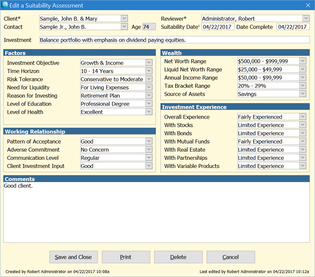

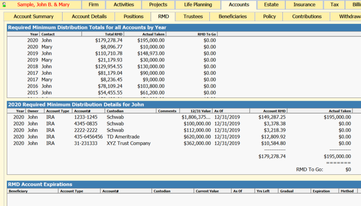

The complexity of each Required Minimum Distribution (RMD) scenario can be mind-boggling. The best approach is to set up each client scenario in a client relationship management (CRM) system such as ProTracker Advantage®.

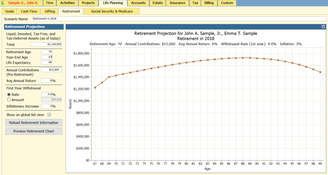

Once the initial parameters for a client scenario are saved, an RMD Wizard may be used to rapidly compute each client’s RMD for the new year. There is no need to look up longevity factors in a table and type them into a spreadsheet.

0 Comments

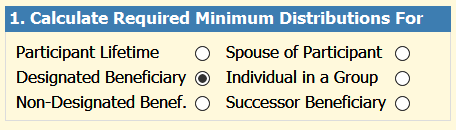

The first step in calculating a Required Minimum Distribution (RMD) is to understand the client scenario. There are six possible scenarios.

|

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed