Financial advisors always need to assure themselves that investment recommendations are suitable for the client’s circumstances. Investment institutions provide a panoply of products from which to choose. Too often, advisors rush to the investment supermarket without performing a cash flow analysis of the client’s situation. Frequently, clients are overspending and need to rein in their consumer consumption.

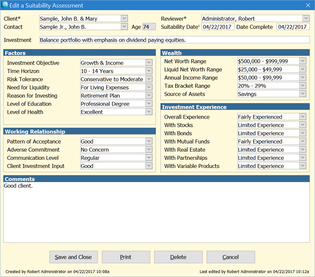

ProTracker Advantage® provides an easy-to-use cash flow template that readily reports the current surplus or deficit. Projected cash flows during retirement may be modeled. One component of a retirement cash flow statement is a required minimum distribution (RMD) amount. ProTracker Advantage® has an extensive RMD calculator and tracking tool to support the advisor in preparing a cash flow analysis. Learn more about calculating RMDs.

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed