|

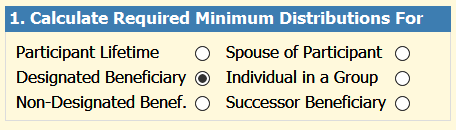

The first step in calculating a Required Minimum Distribution (RMD) is to understand the client scenario. There are six possible scenarios. The rules for calculating an RMD for a participant (a living person) change when the calculation is for the spouse of the (deceased) participant.

If a non-spouse inherits, did the decedent die before 2020? The rules change for deaths after 2019. After the correct scenario has been identified, dates of birth and a date of death (if applicable) need to be entered into the calculator. The plan type for the retirement account must be chosen as there are varying rules for different plan types. Is the participant still working past retirement age? If so, how much ownership in the company does the participant have? Does the participant have a spouse more than ten years younger? Successive steps are shown in related blog articles. Learn more about calculating RMDs and documenting them here.

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed