|

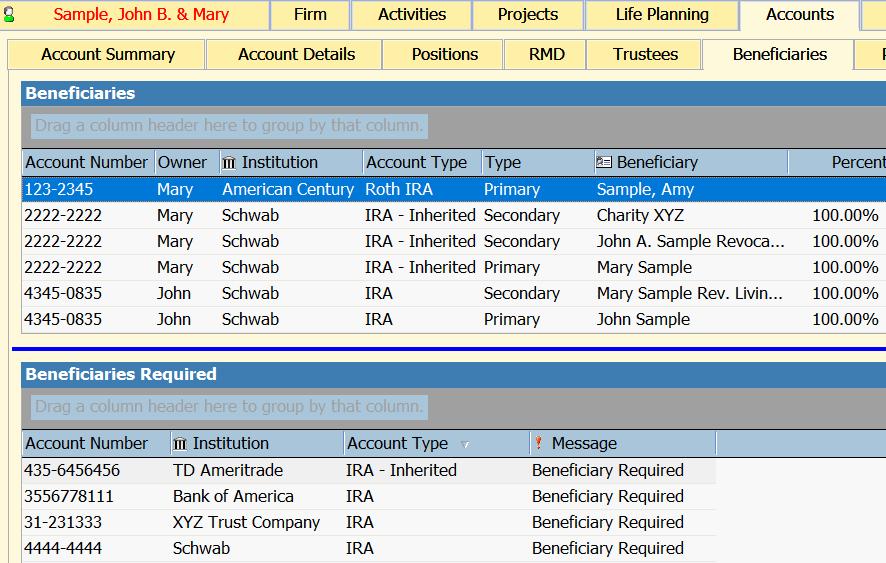

A global report should be available within the CRM to identify client retirement accounts where there are missing beneficiaries. The absence of adequate beneficiary designations should be put on the meeting agenda, prepared from within the CRM, for the next client meeting.

The SECURE Act (2019) and the CARES Act (2020) dramatically altered the retirement landscape. Beneficiary designations took on added importance because the SECURE Act introduced a 10-Year Rule wherein account custodians must distribute the total amount of the retirement account within ten years. Knowing when the 10-year rule expires for each client account is best managed in a CRM, not on a spreadsheet. ProTracker Advantage® provides an extensive and easy-to-use RMD calculator and tracking tool to guide the advisor in distributing the accounts as required. Tax rates come into play as distributions are planned. Documenting the distribution decisions is of paramount importance so that the advisor can remember the client's plan. Click here for more information about calculating RMDs and documenting them.

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed