|

When the SECURE Act (2019) altered the retirement rules, investment advisors became burdened with managing the new 10-Year Rule. Under this rule, account custodians must distribute the total amount of the retirement account to the inheritor within ten years. During the 10-year period, clients need to be apprised of the remaining years left within the 10-year period. Tracking the 10-year rule expiration date for each client account may become cumbersome. The task is best managed using client relationship management (CRM) software, not spreadsheets. ProTracker Advantage® provides built-in screens to guide the advisor in managing distributions within the 10-Year period.

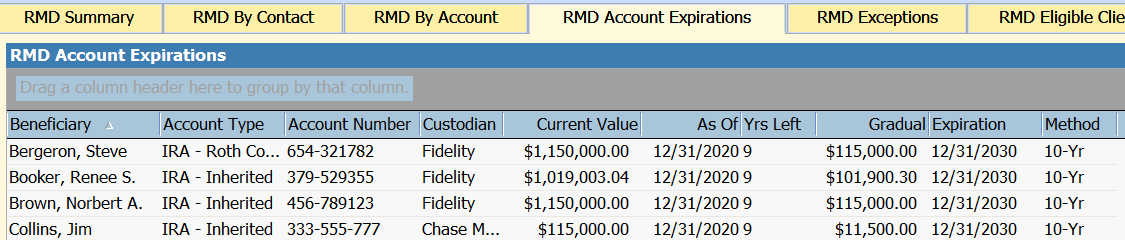

Investment growth and tax implications enter into the equation and affect the timing of distributions. If the inheritance is taken in full the first year, the beneficiary may not maximize investment growth. If the inheritor waits until the tenth year, the beneficiary may be subject to a higher marginal tax rate. Advantage provides an RMD Account Expirations screen to help track the number of years left before the 10-year expiration date. The screen also provides a current “Gradual” amount to suggest fairly even remaining distributions to minimize tax bracket creep.

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed