|

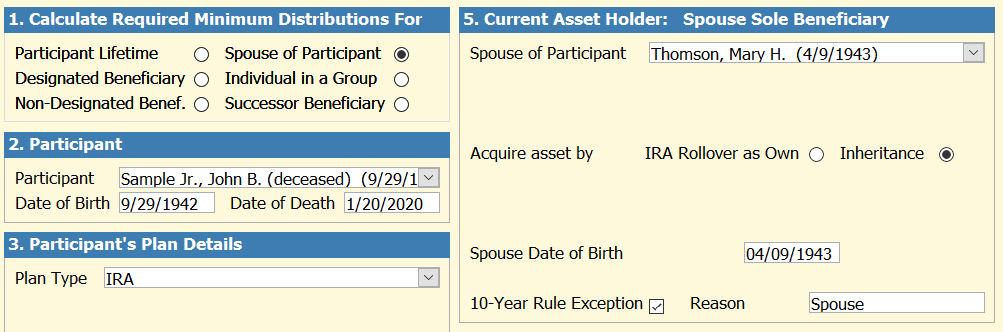

Required minimum distributions (RMDs) for spouses took a slightly new turn under the SECURE Act of 2019. The Required Beginning Date (RBD) was changed to April 1 of the year after the participant would have reached age 72. The RBD age for the past 44 years was 70-1/2. If the participant died before his or her RBD... the ProTracker Advantage® RMD Calculator uses the spouse's attained age for the year of distribution found in the Single Life Table. The calculation is repeated in future years using the spouse's attained age for following year. This is known as the Recalculate Method. The Fixed Term (N-1) Method does not apply to a spouse when the participant died before his or her RBD.

If the participant died after his or her RBD, there are two options. The most favorable option may be selected by the inheritor. The RMD for the year of death must be taken by the decedent's estate using the Uniform Life Table. Thereafter, the factor used is the larger of:

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed