|

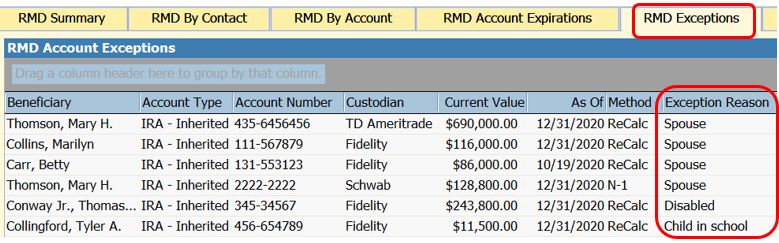

The SECURE Act of 2019 established Required Minimum Distribution (RMD) rules for Eligible Designated Beneficiaries (EDBs) who may extend their distribution period for inherited retirement plans. Financial advisors have a significant responsibility to assure that client retirement accounts are properly set up to reflect the EDB exceptions. EDB exceptions should be documented within the advisor's Client Relationship Management (CRM) system. ProTracker Advantage® makes this job inherently easy. A global RMD Exceptions screen within ProTracker Advantage readily summarizes each client account with EDB exception, along with the reason for the exception. The advisor should review the EDB exception list each year, especially for minor children under the state’s age of majority, and children still in school who may be reaching the end of their EDB exception at age 26.

A task should be created in Advantage to remind the advisor of the need to perform this annual review. Learn more about calculating RMDs and documenting them.

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed