|

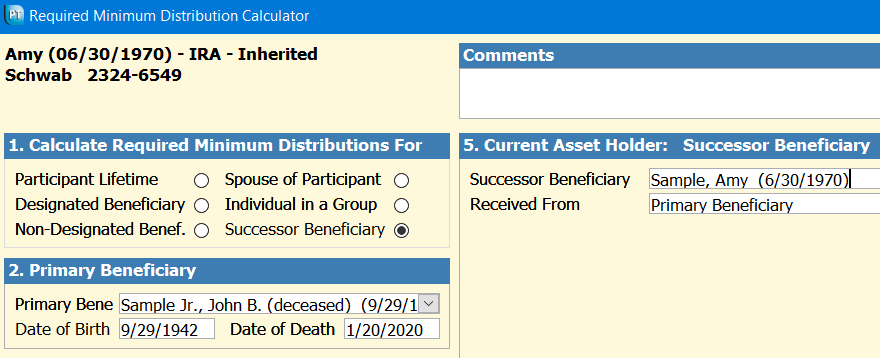

Under the new SECURE Act of 2019 rules, Required Minimum Distributions (RMDs) for beneficiaries inherited after 2019 depend upon the date of death of the Participant. We added a sixth option in Step 1 to accommodate the 10-Year Rule, specifically, the “Successor Beneficiary” option. We now designate the Participant as the “Primary Beneficiary.” All follow-on beneficiaries are “Successor Beneficiaries.” Successor Beneficiaries to the Primary Beneficiary must follow the new 10-Year Rule wherein account custodians must distribute the total amount of the retirement account within ten years. When a Successor Beneficiary dies during the 10-Year Rule payout period, the next Successor Beneficiary falls under the initial Successor Beneficiary’s 10-Year Rule (based on the date of death of the Primary Beneficiary). Effectively, there is no “10-Year Rule reset.”

The marginal tax rates come into play as distributions are made. ProTracker Software’s ProTracker Advantage® client relationship management (CRM) system documents the distribution decisions to assist the advisor in remembering the client's parameters. Learn more about calculating RMDs and documenting them here.

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed