|

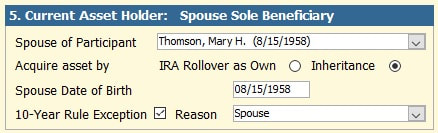

When a spouse inherits a Roth IRA from a decedent spouse, there are two options to acquire the asset and manage the Required Minimum Distributions (RMDs). The first option for the surviving spouse is to take the Roth IRA account as an inherited Roth IRA. The second option is to take the Roth IRA account as his or her own. Under the inherited Roth IRA rules, the survivor faces two RMD calculation methods. The first method is to take distributions using the 10-Year Rule. The second (better) method is to stretch the Roth IRA beyond 10 years and use the life expectancy rule, starting the year after the decedent’s death if the decedent was age 72 or older. If the decedent was less than 72 years of age, spousal RMDs from the inherited Roth account may be delayed until December 31 of the year after the decedent would have turned 72. The life expectancy factor for the survivor is derived from the single life table based on the survivor’s date of birth. However, the survivor gets a bonus because the RMD is recalculated each year using the survivor’s single life expectancy factor for the current year. This recalculation method reduces the annual RMDs somewhat. Click on https://www.protrackerRMD.com to request an online meeting to see a demo of our required minimum distribution (RMD) calculator and tracking system within ProTracker Advantage.

With the announced retirement of Junxure CRM, ProTracker Advantage can provide robust client servicing features. For more information about migrating your current CRM to ProTracker Advantage, click on https://www.protracker.com.

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed