|

The SECURE Act of 2019 introduced a new term “Eligible Designated Beneficiary.” The Act established a 10-Year Rule as the maximum payout period for inherited retirement accounts that were inherited from participants dying after 12/31/2019, with a few exceptions. The exceptions apply to Eligible Designated Beneficiaries (EDBs), defined as follows:

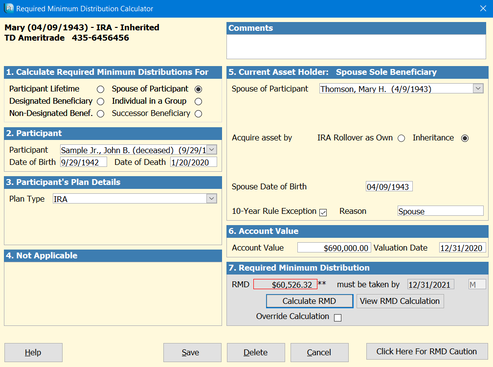

ProTracker Advantage® fully implements the SECURE Act provisions. Here’s an example of the Advantage RMD Calculator setup screen for an Eligible Designated Beneficiary (a spouse). See Step 5 (10-Year Rule Exception checkbox, with Reason): For more information about calculating Required Minimum Distributions and documenting them, click on https://www.protrackerRMD.com.

0 Comments

Leave a Reply. |

|

|

ProTracker RMD Calculator Assistant was developed to take the headache out of calculating and tracking RMDs, which has become even more odious with the new SECURE Act. Our experience as advisors gives us a unique understanding of your needs, and our goal is to make your business more efficient.

To learn more about ProTracker Advantage® (CRM) for your firm, fill out our CRM evaluation form. We respond to all inquiries. |

RSS Feed

RSS Feed